Vice President Harris said on 60 Minutes that teachers, nurses and firefighters have higher tax rates than billionaires. Here’s why that’s misleading.

In the final weeks before the presidential election, Vice President and Democratic presidential nominee Kamala Harris has focused much of her messaging on income inequality.

Harris launched a nationwide ad campaign in which she promises she “will make billionaires pay their fair share.”

That topic came up in a recent interview with “60 Minutes,” where Harris pointed to tax reform as a key aspect of her agenda.

“It is not right that teachers and nurses and firefighters are paying a higher tax rate than billionaires,” she said.

THE QUESTION

Do teachers, nurses, and firefighters pay higher tax rates than billionaires?

THE SOURCES

THE ANSWER

Harris’s claim is misleading. It is not based on numbers from the current tax code. It’s based on a hypothetical formula that seeks to account for wealth that currently goes untaxed for billionaires.

WHAT WE FOUND

To compare how much any two people pay in federal income tax, you need to calculate their effective tax rate, which is not as simple as a set percentage that applies to all income.

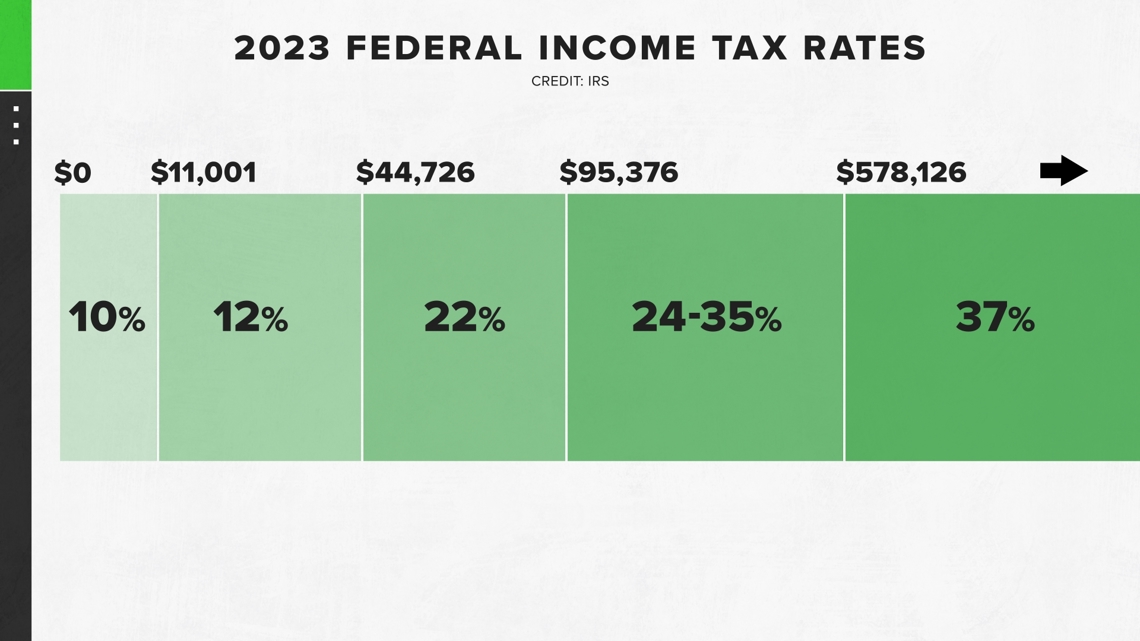

In the American federal income tax system, each time you move up a tax bracket, the tax rate on income that falls in that bracket increases. So for instance, in 2023, that meant your first $11,000 would be taxed at a 10% rate, your next $33,725 would be taxed at a 12% rate, and so on.

The effective tax rate uses these brackets to determine what percentage of your total income actually goes toward federal income tax. It also incorporates capital gains, income made from selling assets like stocks or property, which gets taxed at different, usually lower rates.

Data from the IRS shows that in 2021, the most recent year for which data is available, the average effective tax rate for people making more than $10 million per year was 25.1 percent. Data specifically for billionaires was not available.

Most firefighters, teachers, and nurses make between $50,000 and $100,000 per year, according to the Bureau of Labor Statistics. In that range, the IRS says the average effective tax rate is 7.5 percent.

Various think tanks conducted their own analyses and came up with similar results. They estimate the richest Americans tend to pay around 25 percent, while people making between $50,000-$100,000 per year usually pay between 5 and 15 percent.

Harris, in her claim, is likely referring to an analysis done by White House economists in 2021, which argues that the current tax math doesn’t show the full picture. The White House argues that income needs to be calculated differently to include something called unrealized gains.

Unrealized gains are when people grow their wealth by letting their assets rise in value without selling them. And when they want cash, they can just use that wealth to get good deals on loans, thus avoiding income and taxes.

If unrealized gains were considered taxable income, the White House says the 400 richest American households would really be paying closer to an 8% tax rate right now. And an investigation by ProPublica similarly found that the 25 richest households pay as little as 3% in taxes under this definition.

But the current tax code does not account for unrealized gains, so this is a purely theoretical definition of “tax rate.”

VERIFY found no examples where tax rates as currently defined were higher for middle-class workers than billionaires. However, when some other kinds of taxes besides federal income tax are accounted for, the gap between the rates shrinks.

For instance, all Americans have money for Social Security and Medicare deducted from their paychecks. These are known as payroll taxes, and unlike income taxes there are no brackets; everyone pays the same rate no matter how much they make. Payroll taxes are not applied to capital gains, which for wealthy people is often a larger source of income than a traditional paycheck. Furthermore, income above a certain level stops being subject to Social Security tax at all.

All this means that payroll taxes affect the bottom lines of lower-income Americans more than wealthy ones. An analysis by the Institute on Taxation and Economic Policy found that people making between $50,000-$100,000 wind up paying closer to 15 or 16 percent of their paycheck in total federal taxes. But incorporating payroll taxes did not change the average rate for the wealthiest Americans; it remained at roughly 25 percent.

The gap narrows even further if you account for state and local taxes. ITEP’s analysis found middle class workers could actually be paying more than 27 percent of their income on average, and the richest taxpayers just below 35 percent.

ProPublica’s investigation also found that the richest of the rich often have tax rates well below the average, even without considering unrealized gains, due largely to their use of deductions and having a higher portion of their income come from capital gains. Including just federal income and payroll taxes, the investigation found the wealthiest 25 households averaged a 16 percent rate.